Introduction

In a remarkable achievement for the Indian financial technology sector, the Unified Payments Interface (UPI) has taken a significant leap forward by expanding its presence to 30 countries across the globe. UPI, a revolutionary payment system launched in India, has not only transformed the way Indians make digital transactions but is now making its mark internationally, fostering a new era of seamless and secure global payments. This milestone not only showcases the power and potential of Indian innovation but also highlights the growing recognition of UPI as a game-changer in the world of digital finance.

The Rise of UPI

The Unified Payments Interface was introduced in India in 2016 by the National Payments Corporation of India (NPCI) as a medium to facilitate real-time, peer-to-peer payments. UPI was designed to provide a common platform for various banking services, allowing users to link multiple bank accounts to a single mobile application. This initiative aimed to simplify the digital payment experience for millions of Indians, bringing banking and financial services to the fingertips of every citizen.

The Success Story of UPI

Since its inception, UPI has experienced unprecedented growth and has become the backbone of digital payments in India. Its user-friendly interface, instant fund transfers, and interoperability between different banks have won the hearts of millions. Today, UPI boasts a user base of over 200 million individuals and has witnessed a phenomenal surge in transaction volumes, reaching a staggering 3 billion transactions per month. The success of UPI has not only transformed the way Indians conduct financial transactions but has also inspired numerous other countries to adopt a similar approach.

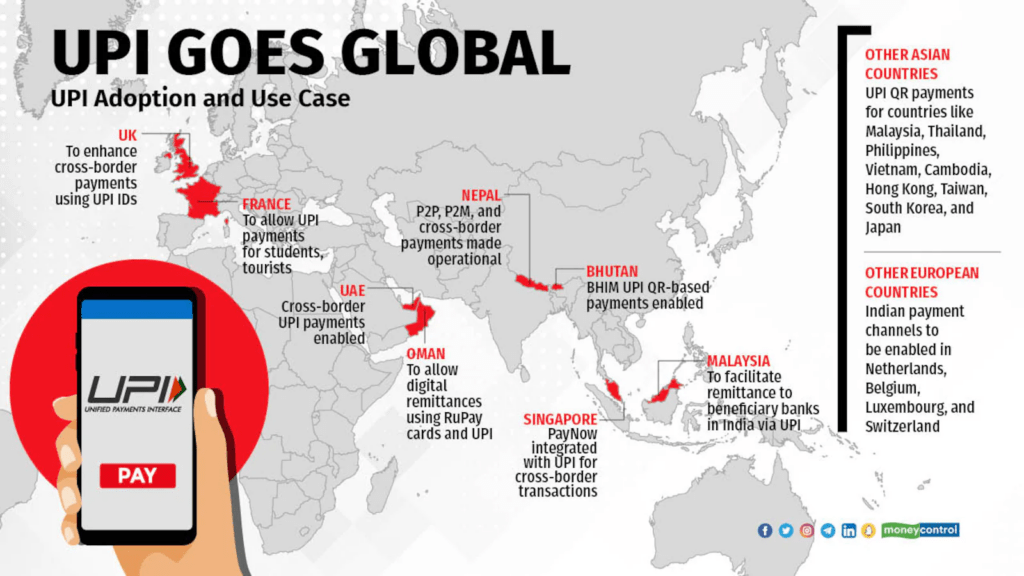

UPI Goes Global

Recognizing the immense potential of UPI, several countries have partnered with Indian fintech companies to implement the UPI system locally. This strategic collaboration aims to leverage the expertise and experience of Indian innovators to enhance digital payment infrastructure worldwide. As of now, UPI is available in 30 countries, including major economies such as the United States, the United Kingdom, Australia, and countries across Europe and Asia. The expansion of UPI globally has opened up new avenues for cross-border transactions, enabling individuals and businesses to send and receive funds seamlessly and securely.

Advantages of UPI on the Global Stage

The expansion of UPI beyond Indian borders offers numerous advantages to users worldwide. Firstly, the UPI system brings convenience and ease to international payments, allowing users to initiate transactions with just a few taps on their smartphones. Secondly, UPI’s robust security features, such as two-factor authentication and encryption, ensure that every transaction is protected from unauthorized access. Thirdly, the interoperability of UPI across different banks and payment service providers fosters healthy competition, driving innovation and improved services in the digital payments landscape.

The Future of UPI

With UPI’s global expansion gaining momentum, the future looks promising for this transformative payment system. The continued collaboration between Indian fintech companies and international partners will likely lead to further enhancements and innovations in digital payment solutions. As UPI continues to penetrate new markets, it has the potential to become the de facto standard for digital payments globally, simplifying financial transactions and empowering individuals and businesses across borders.

Conclusion

The global availability of UPI marks a significant milestone in the Indian fintech revolution. From its humble beginnings as a domestic payment system, UPI has now emerged as a global player, transforming digital payments worldwide. As more countries embrace this innovative platform, the era of seamless and secure cross-border transactions becomes a reality. The expansion of UPI highlights the power of Indian innovation and establishes India as a key player in shaping the future of digital finance. With UPI leading the way, the world moves closer to a more connected and financially inclusive future.